Robi’s net profit rises 16pc in 2021

Business Desk

Published:17 Mar 2022, 11:47 AM

Robi’s net profit rises 16pc in 2021

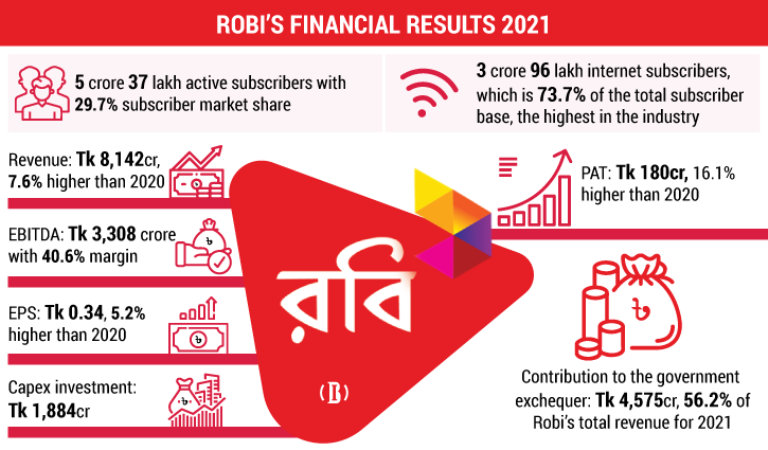

Mobile phone operator Robi’s net profit in 2021 jumped to Tk 180 crore, up 16.1pc from 2020. Robi, while releasing its financial results for 2021 on Wednesday, said its profit after tax (PAT) in Q4 of 21 was Tk 13 crore. However, the PAT figure could have reached a far more appealing figure of 343 crore taka, if the 2pc minimum turnover tax were removed, it said.

EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) in Q4’21 was Tk 781 crore (with 38.2pc margin), while the EBITDA for 2021 reached Tk 3,308 crore (with 40.6pc margin), marking a rise of 2.7pc compared to 2020.

Robi’s total contribution to the government exchequer reached Tk 4,575 crore in 2021, including Tk 1,205 crore in Q4. Robi contributed 58.9pc of its revenue in Q4 and 56.2pc of its revenue in 2021 to the government exchequer.

The company’s earnings per share (EPS) in Q4 was Tk 0.02; EPS for 2021 was Tk 0.34, which was 5.2pc higher than the same in 2020.

Robi’s 4G leadership position further consolidated in 2021 with 44.4pc of its total subscribers being 4G users. Around 73.7pc of Robi’s subscriber base was data subscribers in 2021, which was the highest in the industry.

Robi ensured 98.1pc population coverage of its 4G network with 14,822 4G sites. Compared to 2020, data usage per subscriber, per month, increased by 41.1pc in 2021. In 2021, each Robi data subscriber consumed 4GB data every month on an average.

Robi’s subscriber base grew by 5.4pc compared to 2020 to reach 5 crore 37 lakhs at the end of 2021, representing 29.7pc of the subscriber market share; on the other hand, data subscriber base grew by 12.3pc in 2021, compared to 2020 to reach 3 crore 96 lakh.

Meanwhile, compared to 2020, Robi’s 4G subscriber base grew by 43.8pc in 2021 to reach 2 crore 38 lakh.

With Tk 2,046 crore revenue in Q4, Robi’s revenue in 2021 reached Tk 8,142 crore. Compared to 2020, revenue rose by 7.6pc in 2021. Compared to Q4, revenue rose by 6.5pc in Q4.

Voice revenue in 2021 increased by 7.8pc, compared to 2020. Compared to Q4, voice revenue rose by 11.7pc in Q4. Data revenue in 2021 increased by 11.8pc, compared to 2020. Compared to Q4’20, data revenue rose by 1.9pc in Q4’21. Including Tk 499 crore CAPEX investment in Q4, Robi’s total CAPEX investment for 2021 reached Tk 1,884 crore.

Robi’s board of directors has recommended a final cash dividend at the rate of 2pc (Tk 0.20 per share). Therefore, including the 3pc interim cash dividend paid out earlier in 2021, the total cash dividend paid in 2021 is 5pc (Tk 0.50 per share), which represents 145.3pc of the PAT for 2021. The decision was made at the board meeting held on Tuesday. Robi’s 26th Annual General Meeting is scheduled to be held on April 28.

Commenting on the financial performance of the company, Robi’s Acting CEO and CFO, M Riyaaz Rasheed said: “We are happy to see our growth strategy consistently working in the market. Robi made the highest revenue growth for the third consecutive year in 2021. With consolidation of 4G leadership position, we are on track with our digital transformation journey powered by innovation.”